Revenue forecasting is an important component of state budgeting. Without accurate predictions of incoming revenues, states could either allocate more than their available resources or underfund priorities when money is available. As a safeguard, Michigan’s system asks the House, Senate, and Executive Branch to reach consensus on revenue projections.

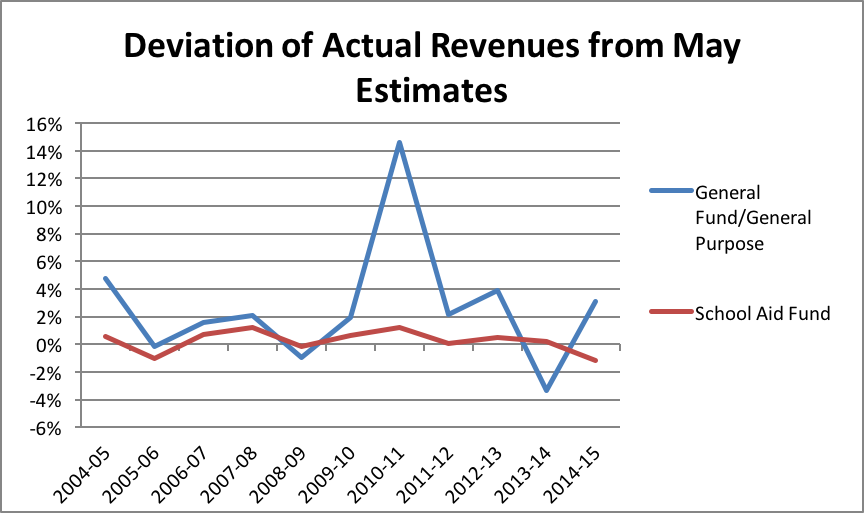

How accurate are the state consensus revenue estimates? What direction do they tend to falter? We examined the estimates for the following fiscal years from 2004-2015 and compared them against actual results to assess their accuracy. Actual revenue numbers are found in the consensus revenue summaries up to three years after the beginning of the fiscal year.

On average, Michigan’s General Fund/General Purpose revenues were 3% greater than Michigan’s May estimates. The May conference is used to refine the estimates from the January conference. The largest deviation from estimates was in fiscal year 2011 when revenues came in 17.13% higher than estimated. Michigan was most accurate in fiscal year 2006, when state revenue came in less than 1% higher.

As the chart demonstrates deviations were not always in the same direction. The average deviation in absolute terms was $309 million.

School Aid Fund revenue remained much closer to the estimates because it comes from more consistent sources. On average, Michigan School Aid Fund revenue came in less than 1% over the May estimates, and unlikely to cause significant distortions in policy. In 2008 and 2011, School Aid Fund estimates were most inaccurate, with final revenue off by approximately 1.2%.

But Michigan makes adjustments in its revenue estimates between January and May based on early data. The January estimates are, of course, not as good as the May estimates. On average, January General Fund revenue estimates were off by $494 million, an average 6% error from the initial projection. School Aid Fund estimates were off by $175 million on average, an error of only 1.6% from the initial projections.

Revenue estimations in Michigan have been relatively close and consistent. State agencies incorporate evidence from state and national economic forecasts and outlooks and reach consensus between three different initial estimates. These estimates are carried out by the House Fiscal Agency, The Senate Fiscal Agency, and the Michigan Department of Treasury (administration).

These three original estimates, when examined individually are significantly more inaccurate than their consensus counterpart. The House on average underestimates revenues by 3.9%, and the Senate and Administration do even worse with an average of over 7% underestimation. The Administration estimates are on average off by 10% in absolute terms and the Senate was more inaccurate with average deviations of 11.5%. The House’s estimates were more accurate, being off by 5.1% on average in absolute terms (though there were 4 fewer reported estimates available to compare, which could have skewed results).

The January revenue estimates follow the same pattern. On average, the January estimates of the House, Senate, and administration were off by a deviation of 12.3%, 8.4% and 13.8% respectively, compared with initial estimates deviation of 6% on average; this is evidence of the effectiveness of consensus revenue estimation (though Senate January revenue estimates were missing for a few years, which could affect results).

These numbers help to demonstrate the effectiveness of Michigan’s revenue estimating laws. As the chart below demonstrates, the consensus revenue estimates showed significantly less error than any of the other three.

Comparatively, the deviations from the consensus are rather small. Yet even small deviations can potentially distort policymaking—and estimates are occasionally off by more significant amounts.

This January, the state estimated $11,000,000,000 in General Fund revenue for FY 2020-2021, which is $321 million more in revenue than the previous year. The May estimate will be closer to the initial estimate, but by that time the expected revenues will be used to allocate expenditures. For the next fiscal year in October 2020, the general fund will have $274 million more in revenue than the previous year that brings the total up to $11.2 billion. The School Aid Fund will have $138 million, which will bring more in revenue bringing the total up to $14.3 million.

State Budget Director Chris Kolb warns Michigan has seen modest growth, but this isn’t extra money to spend. The general fund has been flat for 20 years and based on estimates from the House Fiscal Agency the state hasn’t fully recovered from the recession. If Michigan had kept up with inflation the general fund would have $5 billion more in revenue. The budget is facing growing pressure, but the state has to meet ongoing costs and obligations from programs.

The Michigan process gives the state a significant leg-up compared to a process where only the Executive Branch is involved in estimation, but revenue estimation is still an inexact science.